Mastercard, Visa, American Express, Discover: One Is The Ultimate ... - Seeking Alpha

ronniechua

This article was published on Dividend Kings on Monday, April 10th.

---------------------------------------------------------------------------------------

Oh, how the market's economic narrative has changed this year.

In January, hopes of a soft landing created the 8th-best January rally in U.S. history.

In February, a red-hot jobs report had Wall Street abuzz about a "no landing" scenario where economic growth didn't even slow down.

And March's banking crisis suddenly had us worrying about a hard landing.

The February jobs report brought good and bad news. 236K net jobs with 4.2% wage growth is a solid report, and over 1 million jobs created in three months means we're not yet in recession.

But before you get too excited about a return to a "soft landing" stock market, let's not forget about two important facts.

First, the banking crisis isn't over yet, and probably won't be for many months, if not years. The savings and loan, or SNL, crisis of the 1980s was created by the same risks we face today, a sharp increase in short-term interest rates.

Before the SNL crisis ended, 30% of savings and loans failed, and Congress ultimately had to bail out the industry.

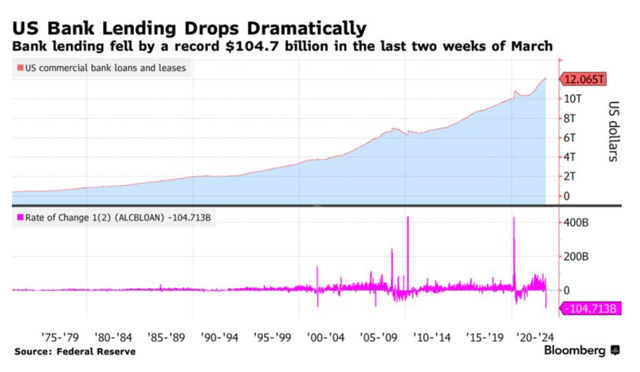

Commercial bank lending fell by $105 billion in the last half of March, the largest decline in recorded history.

Bloomberg

This is evidence of the credit crunch that JPMorgan thinks could reduce U.S. growth in 2023 by as much as 1%.

But while there are plenty of reasons to worry about growth, we can't forget inflation isn't dead yet, not even close.

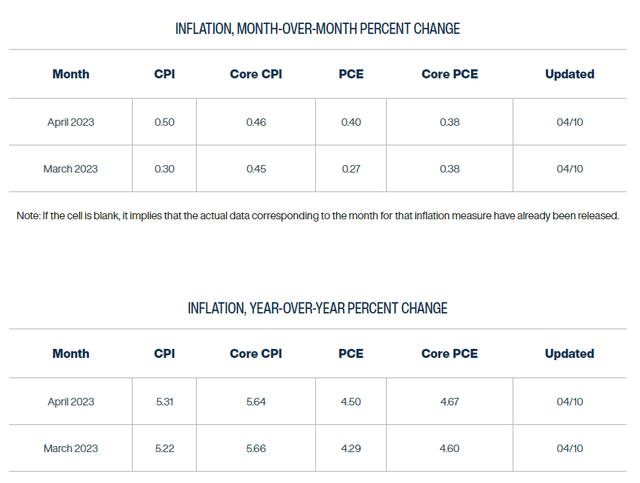

Cleveland Federal Reserve

Inflation is expected to come in at 5.2% for March (the April report) and then go up to 5.3% in May.

Core inflation is expected to stay 4.6% in April and then go up to 4.7% in May.

The month-over-month inflation rate is expected to go up to 6.2% (annualized) in May and 4.9% for core inflation.

Economists expect (and hope) inflation starts falling quickly in the 2nd half of the year due to rental inflation lagging by about a year.

But economists have been wrong about inflation for nearly two years now, and for now, the data points to both a rapidly slowing economy... and sticky inflation.

It's the worst of both worlds, and the bond market thinks a recession will likely start by July.

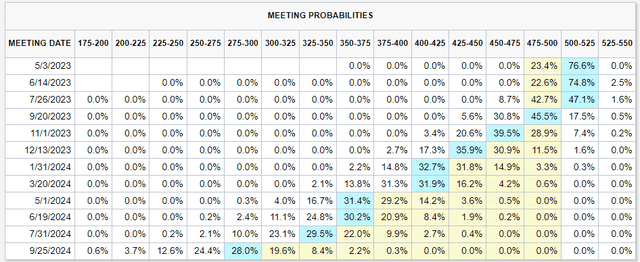

CME Group

The economic data supports that forecast, but not the Fed starting to cut rates in September.

Every Fed president of the last week has been very clear; the Fed plans to hike to 5% and then keep the Fed funds rate there all year, at least.

Unless inflation falls off a cliff, there will be no rate cuts, nor bond buying. The Fed's normal recession playbook is off the table.

Remember, we're facing the worst inflation in 42 years. The last time inflation was this bad, Paul Volker had to create two severe recessions on purpose with diabolically high 20% interest rates.

Paul Volker was a mentor of Jerome Powell, and there hasn't been any indication from anyone at the Fed, not even the doves, that a fast-Fed pivot is coming.

The good news is that the economy is likely strong enough to avoid a severe recession. The bad news is there is no Fed put for the economy or stock market.

And that brings us to today's article, looking at payment processors Mastercard Incorporated (MA), Visa Inc. (V), American Express Company (AXP), and Discover Financial Services (DFS).

Several Dividend Kings members have asked for a compare and contrast of the payment processors from the perspective of recession safety.

All four are great companies that I happily own. But just two of them are Ultra SWANs (sleep well at night), and one is the ultimate Ultra SWAN for this and all future recessions.

Battle Of The Balance Sheets: Winner Visa (By A Hair)

In a recession, you first want to know how strong a company's balance sheet is. Because if bond investors don't get paid a company declares bankruptcy, and then stock investors get wiped out.

That's the way stocks work; they are the bottom of the "capital stack." If a company prospers, stock investors get all the upside; if it fails, they get nothing at all.

The Best Proxy For Fundamental Risk

| Credit Rating | 30-Year Bankruptcy Probability |

| AAA | 0.07% |

| AA+ | 0.29% |

| AA | 0.51% |

| AA- | 0.55% (Visa) |

| A+ | 0.60% (Mastercard) |

| A | 0.66% |

| A- | 2.5% |

| BBB+ | 5% (American Express) |

| BBB | 7.5% |

| BBB- | 11% (Discover) |

| BB+ | 14% |

| BB | 17% |

| BB- | 21% |

| B+ | 25% |

| B | 37% |

| B- | 45% |

| CCC+ | 52% |

| CCC | 59% |

| CCC- | 65% |

| CC | 70% |

| C | 80% |

| D | 100% |

(Source: S&P.)

Rating agencies consider Visa's balance sheet to be slightly stronger than Mastercard's, but barely.

Visa Credit Rating

| Rating Agency | Credit Rating | 30-Year Default/Bankruptcy Risk | Chance of Losing 100% Of Your Investment 1 In |

| S&P | AA- Stable Outlook | 0.55% | 181.8 |

| Moody's | AA3 (AA- equivalent) Stable Outlook | 0.55% | 181.8 |

| Consensus | AA- Stable Outlook | 0.55% | 181.8 |

(Sources: S&P, Moody's.)

Visa's fundamental risk is 0.55%, or a 1 in 182 chance of losing all your money in the next 30 years.

Mastercard Credit Rating

| Rating Agency | Credit Rating | 30-Year Default/Bankruptcy Risk | Chance of Losing 100% Of Your Investment 1 In |

| S&P | A+ Stable Outlook | 0.60% | 166.7 |

| Moody's | AA3 (AA- equivalent) Stable Outlook | 0.55% | 181.8 |

| Consensus | A+ Stable Outlook | 0.58% | 173.9 |

(Sources: S&P, Moody's.)

Mastercard's fundamental risk is 0.58%, a 1 in 174 chance of going to zero in the next 30 years.

For context, Goldman estimates the risk of nuclear war with Russia during the Ukraine war is approximately 2.5% or 1 in 40.

- The risk of MA or V going to zero is less than 25% that of a nuclear apocalypse.

If you aren't losing sleep over Putin's nukes, you shouldn't worry about your savings in Visa or Mastercard.

In contrast, AXP's fundamental risk is slightly higher, on par with Enbridge Inc. (ENB) or British American Tobacco p.l.c. (BTI). That's because of the credit risk inherent in its business model.

Discover also has credit risk but a more economically sensitive portfolio of loans, similar to Ally Financial Inc. (ALLY).

| Company | Cash | Debt | Net Debt | 2023 Free Cash Flow Consensus |

| Mastercard | $7,997 | $14,023 | $6,026 | $11,866 |

| Visa | $18,577 | $20,487 | $1,910 | $20,001 |

| American Express | $33,596 | $43,918 | $10,322 | $8,193 |

| Discover | $1,541 | $20,108 | $18,567 | $3,407 |

(Sources: FactSet Research Terminal.)

In addition to having no credit risk and more stable earnings profiles, Mastercard and Visa have less net debt than AXP or DFS.

They also have far higher free cash flow margins thanks to very capital-light business models.

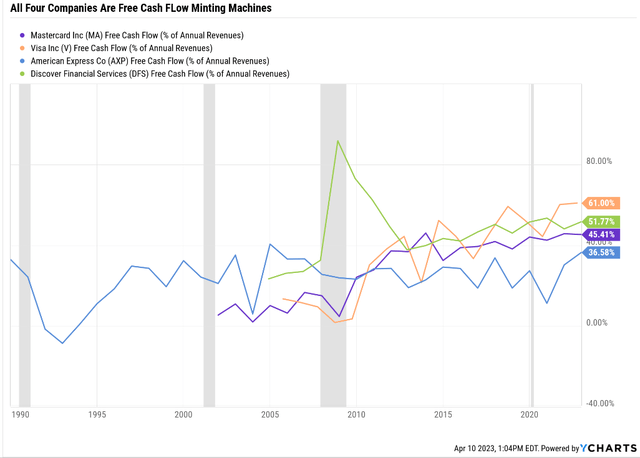

Ycharts

While all four companies mint free cash flow at prodigious rates, Mastercard and Visa's capital-light business models means 50% to 60% of every dollar coming in the door drops straight to the bottom line.

Business Model Resiliency: Tie Mastercard And Visa

How about recession-resistant business models? Won't both Mastercard and Visa suffer in a recession? Yes, but not as much as you might think.

Unlike Discover or American Express, Visa and Mastercard are pure payment processors. They don't extend credit and have zero risk of credit losses in a recession.

That's why they tend to have more stable earnings during recessions.

| Company | Pandemic EPS Decline | Great Recession EPS Decline | Average Severe Recession Decline |

| Mastercard | -17% | 18% | 0% |

| Visa | -7% | 30% | 12% |

| American Express | -53% | -55% | -54% |

| Discover | -60% | -90% | -75% |

(Sources: FAST Graphs, FactSet.)

Discover suffers from both a poorer customer base that defaults more in recessions, and a much smaller size, meaning lower economies of scale. Its fixed costs are a higher percentage of its revenue, and thus when loans default in a severe recession, its earnings tend to fall off a cliff.

AXP's clientele is richer; thus, it has fewer loan losses in a typical severe recession and larger economies of scale.

However, Visa and Mastercard have no credit risk and have historically preserved earnings or even grown them in even the most severe recessions.

But this isn't expected to be a severe recession, but the 2nd mildest in U.S. history.

| Company | 2022 EPS Growth | 2023 EPS Consensus Growth | 2024 EPS Consensus Growth | Average Growth Rate |

| Mastercard | 27% | 15% | 18% | 20% |

| Visa | 27% | 13% | 14% | 18% |

| American Express | -2% | 14% | 14% | 9% |

| Discover | -13% | -12% | 5% | -7% |

(Sources: FAST Graphs, FactSet.)

Naturally, these estimates will change in the coming weeks, but you can clearly see how when it comes to payment processors, Mastercard and Visa are the clearly better choices.

Mastercard's superior average growth rate is courtesy of its slightly faster growth rate compared to Visa.

| Company | Yield | Long-Term Growth Consensus | Long-Term Consensus Total Return Potential |

| Mastercard | 0.6% | 21.8% | 22.4% |

| Visa | 0.8% | 16.3% | 17.1% |

| American Express | 1.5% | 11.5% | 13.0% |

| Discover | 2.5% | 16.0% | 18.5% |

(Sources: DK Research Terminal, FactSet.)

Quality And Long-Term Risk Management: Tie Mastercard And Visa

Dividend Kings uses a comprehensive 3,000-metric safety and quality model that includes over 1,000 metrics to estimate the risk of a dividend cut and successful long-term investment.

DK uses S&P Global's global long-term risk-management ratings for our risk rating.

- S&P has spent over 20 years perfecting their risk model

- which is based on over 30 major risk categories, over 130 subcategories, and 1,000 individual metrics

- 50% of metrics are industry specific

- this risk rating has been included in every credit rating for decades.

The DK risk rating is based on the global percentile of a company's risk management compared to 8,000 S&P-rated companies covering 90% of the world's market cap.

S&P's risk management scores factor in things like:

- supply chain management

- crisis management

- cyber-security

- privacy protection

- efficiency

- R&D efficiency

- innovation management

- labor relations

- talent retention

- worker training/skills improvement

- customer relationship management

- climate strategy adaptation

- corporate governance

- brand management

- regulatory risk management.

| Company | Safety Score | S&P Long-Term Risk Management Rating | Overall Quality Score | Overall Quality Rating |

| Mastercard | 100% | 82% Very Good | 100% | Very Low Risk 13/13 Ultra SWAN |

| Visa | 100% | 84% Very Good | 99% | Very Low Risk 13/13 Ultra SWAN |

| American Express | 88% | 76% Good | 93% | Low Risk 12/13 Super SWAN |

| Discover | 73% | 59% Average | 76% | Medium Risk 10/13 Blue-Chip |

(Sources: DK Research Terminal, S&P.)

The chances of a dividend cut from V or MA are insignificant and very low for AXP.

| Company | Safety Score | Risk of Dividend Cut In Average Recession | Risk of Dividend Cut In Severe Recession |

| Mastercard | 100% | 0.50% | 1.00% |

| Visa | 100% | 0.50% | 1.00% |

| American Express | 88% | 0.50% | 1.60% |

| Discover | 73% | 1.00% | 2.70% |

(Sources: DK Research Terminal.)

Margin Of Safety: Winner Discover

DK uses a company's historical market-determined fair value to estimate its margin of safety.

According to Ben Graham, over the long-term the market almost always correctly "weighs the substance of a company," including its moatiness, business model, management quality, brand value, cash flow stability, and risk profile.

| Company | Current Price | Historical Fair Value | Discount To Fair Value | DK Rating |

| Mastercard | $359.30 | $418.82 | 14.21% | Potential Good Buy |

| Visa | $225.47 | $276.51 | 18.46% | Potential Strong Buy |

| American Express | $160.50 | $175.41 | 8.50% | Potential Reasonable Buy |

| Discover | $98.07 | $147.99 | 33.73% | Potential Strong Buy |

(Sources: DK Research Terminal.)

All four payment processors are potentially reasonable buys or better, though American Express is just slightly above its good buy price of $157.87.

- 10% margin of safety adequately compensates investors for its risk profile as a low-risk 12/13 Super SWAN quality company.

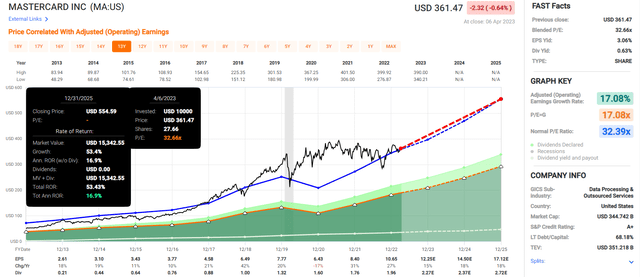

Mastercard 2025 Consensus Total Return Potential

FAST Graphs, FactSet

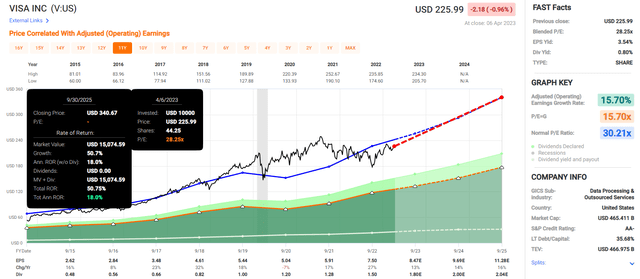

Visa 2025 Consensus Total Return Potential

FAST Graphs, FactSet

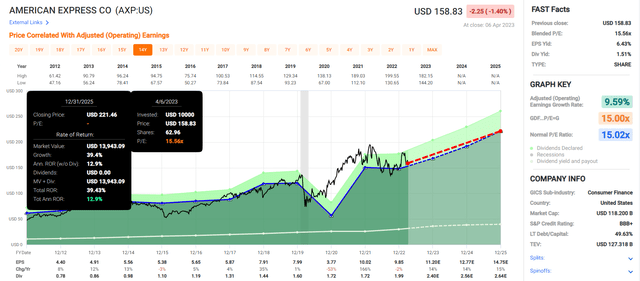

American Express 2025 Consensus Total Return Potential

FAST Graphs, FactSet

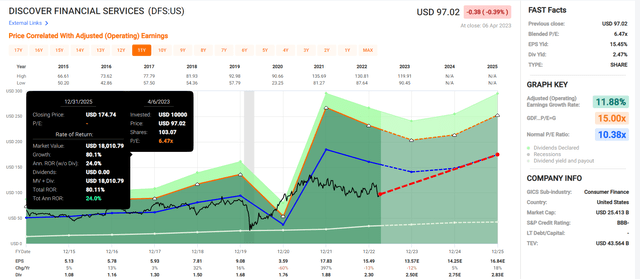

Discover 2025 Consensus Total Return Potential

FAST Graphs, FactSet

Discover has the best valuation by far. However, Visa and Mastercard's superior growth profiles mean that both offer highly attractive double-digit return potential.

AXP, though merely a reasonable buy, still offers 13% return potential through 2025, an attractive return about 30% better than the S&P 500.

Bottom Line: Buy Mastercard Or Visa Today, And You'll Sleep Well During The Coming Recession

Let me be clear: I'm NOT calling the bottom in MA, V, AXP, or DFS (I'm not a market-timer).

Even Ultra SWANs can fall hard and fast in a bear market.

Fundamentals are all that determine safety and quality, and my recommendations.

- over 30+ years, 97% of stock returns are a function of pure fundamentals, not luck

- in the short term; luck is 25X as powerful as fundamentals

- in the long term, fundamentals are 33X as powerful as luck.

But here is what I can tell you about these payment processors' fundamentals.

All four companies are high quality and worth owning at the right price.

All four are trading at reasonable to attractive valuations, though DFS has the best discount to fair value.

Mastercard and Visa have the most recession-resistant business models due to their lack of credit risk, and thus their A+ and AA- credit ratings.

American Express is expected to ride out the mild recession with modest growth thanks to lower default rates from a richer customer base.

Discover is expected to face a modest earnings decline in the 2023 recession due to its lower economies of scale and riskier loan portfolio.

Long term, MA and Discover are expected to deliver the best long-term returns, though V is right behind DFS, and even AXP's 13% return potential is on par with what dividend blue-chips have delivered for the last 50 years.

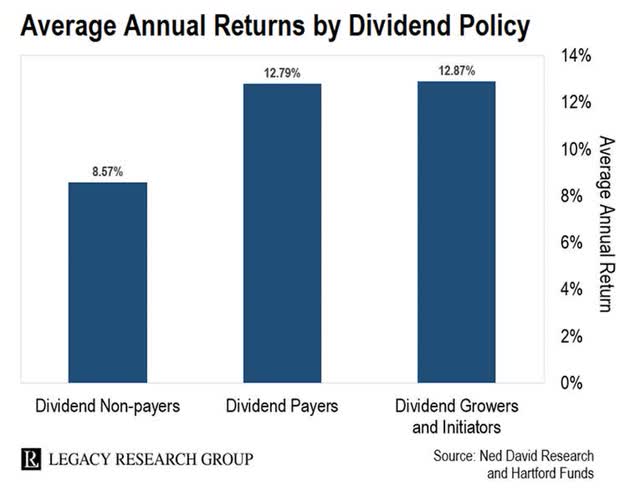

Legacy Research

If you want the ultimate SWAN for the coming recession, Mastercard's 100% quality, very good risk management, fortress balance sheet and slightly stronger 2023 growth outlook give it the slight edge over Visa.

AXP comes in 3rd, and DFS a more distant 4th place, though its risk of a dividend cut remains low at around 1%.

Personally, I like Mastercard the most of all payment processors due to its slightly superior growth profile and 100% quality that makes it as close to God's own dividend growth stock as exists on Wall Street.

Commentaires

Enregistrer un commentaire